BFSI is a collective abbreviation for Banking, Financial Services, and Insurance Service Providers. A crucial sector witnessing rapid growth and expansion, Financial Services in India have undergone significant transformation over the last decade. Also, the emergence of Fintech players has altered the face of this industry, making it far more competitive, diverse, and multi-faceted. With the increased popularity of digital payments and the push towards a cashless economy, the traditional aspects of the BFSI Sector are being fast replaced by modern ones. Considering these radial changes, the need to cast away outdated promotional practices and embrace new-age marketing strategies is necessary.

Digital Marketing for the Finance Sector

When most other industries in India successfully switched over from traditional marketing to digital marketing long ago, the Finance Sector largely stayed aloof owing to its tricky norms and regulations. BFSI service providers never considered availing digital marketing services at that time. It is only over the last decade that digitization changed the way banks and NBFCs (Non-Banking Financial Companies) work. Recognizing the immense benefits of digitization, key finance players also began to understand the alluring prospects of digitally reaching out to prospective clients (both individuals and organizations), online brand promotions, and content marketing. The Covid-19 pandemic gave yet another push to online marketing in the Finance Sector, with a heightened emphasis on contactless banking and digital financial services.

Opportunities Unlocked by Digital Marketing for BFSI

The scope of digital marketing in the realm of Banking, Financial Services, and Insurance is multi-fold. As this industry is becoming increasingly competitive, digital marketing platforms can help service providers foster an excellent brand image and aid in better market penetration.

A digital marketing agency for BFSI enables Finance Businesses to reach out to a wide target audience quickly and more effectively. Not just the private sector but even public sector banks are reaping the massive potential of online marketing and digital promotions.

Here are the opportunities unlocked by digital marketing for BFSI service providers:

Massive Client Outreach with Minimal Investment

Be it selling insurance services, home loans, personal loans, or providing investment assistance, generating viable leads online is a massive opportunity for service providers. Telemarketing has certain limitations, but digital marketing can provide a huge outreach, especially if one liaises with experts.

Goes Hand in Hand with Contactless Services

Today, most clients no longer want to visit the bank or NBFC office regularly. They want to access all the important services as well as information online, preferably using their smartphones. In the absence of face-to-face conversations, the only way service providers can communicate and influence clients is via digital marketing. Businesses can easily up-sell, cross-sell, and inform prospects about the launch of new services.

Ensuring the Financial Literacy of the Target Audience

The financial awareness of prospective clients is a prerequisite before any BFSI service provider attempts to sell to them. Digital marketing platforms provide an excellent opportunity for Fintech players to educate their target audience. With well-researched blogs, social media posts, gated content (whitepapers, e-books), and responses to queries on popular forums, businesses can disseminate the right knowledge. Once their target audience is financially well-aware, they can proceed with promoting their offerings.

Boosts Brand Awareness with Trust-Building

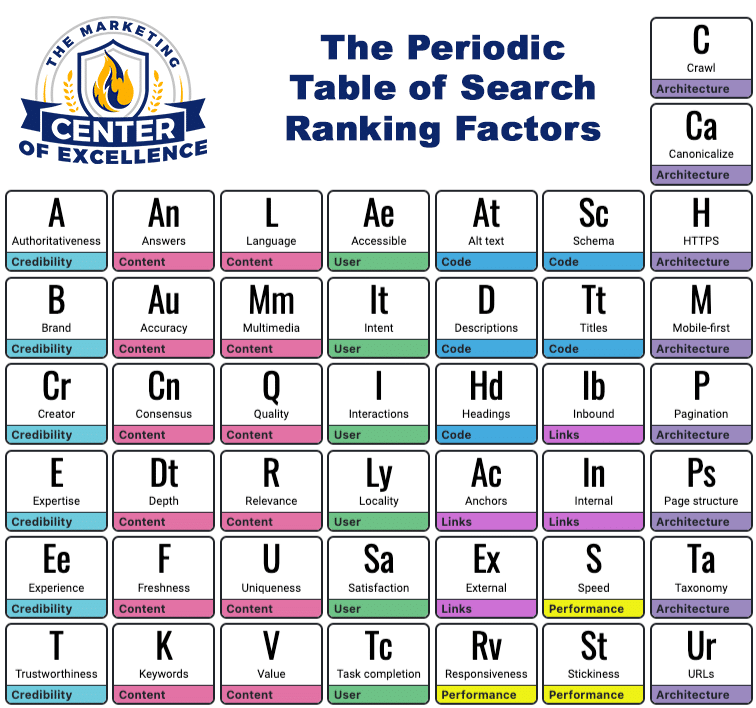

For start-ups in the Finance Industry today, it is becoming increasingly challenging to compete with well-established businesses. The only way to disrupt the existing market and influence prospects is by fostering brand recognition and trust. With high-quality content marketing and a robust SEO strategy, service providers can feature in the top search results. This will boost organic traffic to their website, enhance their brand appeal, and ensure that the top-notch content grabs the right eyeballs.

Data-Driven Insights for Better Customization

Like any other industry, data analytics and AI are playing an important role in shaping business strategies. Data-driven digital marketing provides crucial insights into consumer search patterns and browsing behavior. This information is extremely helpful for service providers to customize new services to meet the exact requirements of their target audience.

Building Authority and Online Reputation Management

Trust is pivotal in the Finance Sector. No matter how many brand promotions and paid advertisements a business invests in, the final conversions figures and revenue rely on the trustworthiness of the brand. By posting relevant and useful content regularly, getting positive reviews and mentions in online forums, and initiating engaging social media conversations, BFSI service providers can derive great benefits.

Conclusion

From better lead generation and client engagement to higher conversions and longstanding brand loyalty, there are multiple advantages of availing digital marketing services for BFSI service providers. Using data-driven insights on client behaviour and preferences can help them formulate highly attractive promotional strategies. The right digital marketing team can help Finance Businesses entice, engage, and impress the target audience for higher revenue generation. In the long run, this is far more profitable than investing in traditional media and print advertisements.